Stock intrinsic value calculator excel

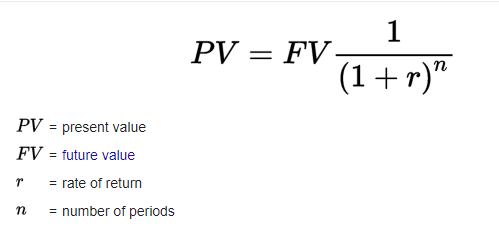

5500 after two years we need to calculate a present value of Rs. 5500 is higher than Rs.

How To Calculate Intrinsic Value Formula Excel Template Amzn Example Sven Carlin

Whether Company Z should take Rs.

. 5000 today or Rs. Thus the existing shareholders ownership stake in the company who bought the shares during its initial offering becomes smaller. 5000 then it is better for Company Z to take money after two years otherwise take Rs.

Now in order to understand which of either deal is better ie. The concept of dilution comes into play when a company decides to issue additional stock usually through a secondary offering. 5500 on the current interest rate and then compare it with Rs.

5000 if the present value of Rs. You can use the following Dilution Formula Calculator.

How To Find The Intrinsic Value Of A Stock In Excel Graham Intrinsic Value Formula Youtube

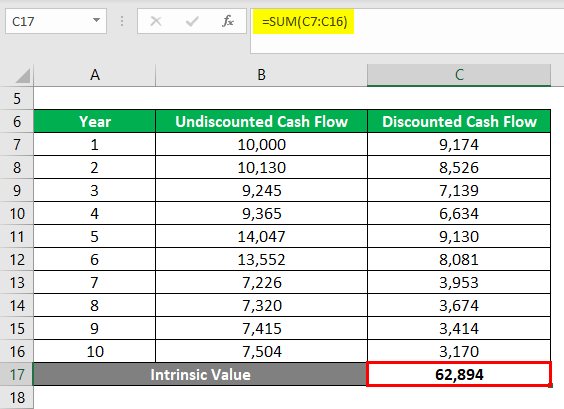

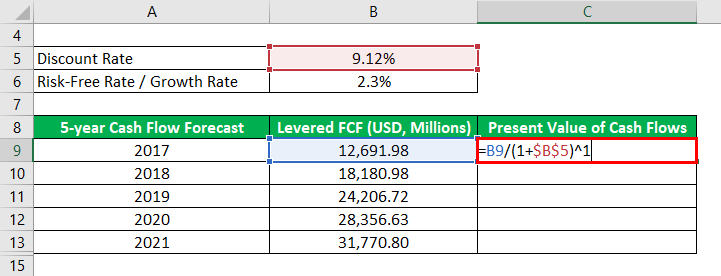

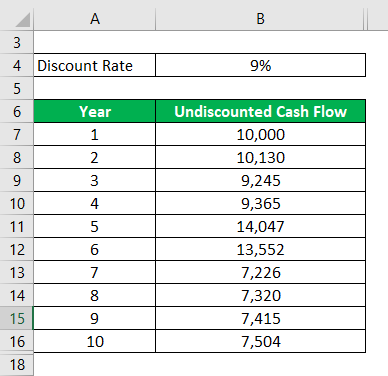

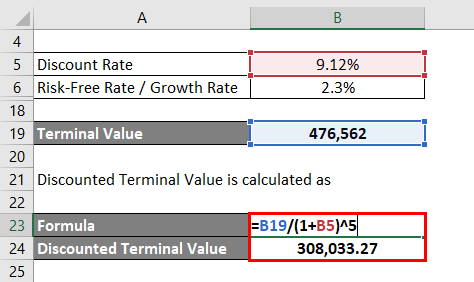

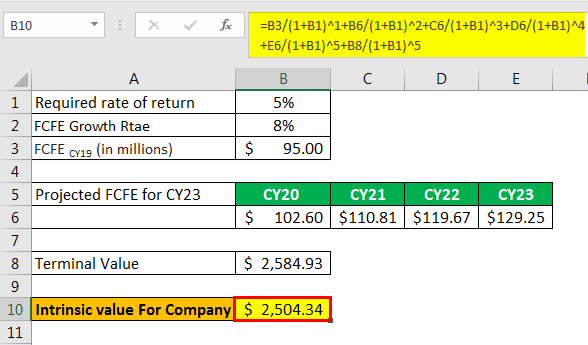

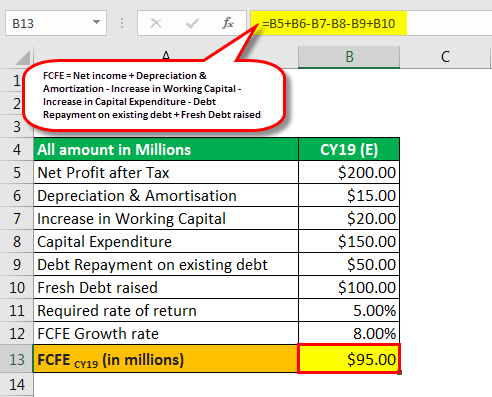

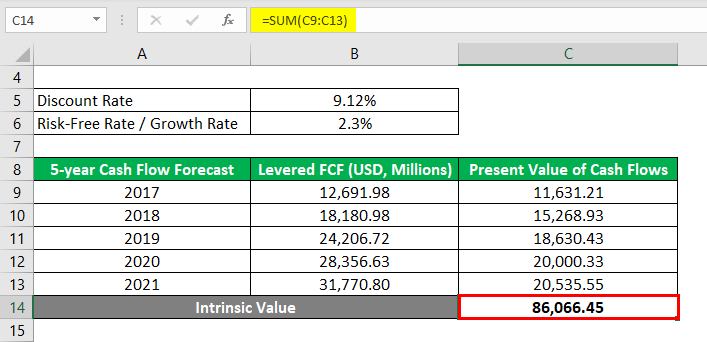

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

How To Calculate Intrinsic Value Formula Excel Template Amzn Example Sven Carlin

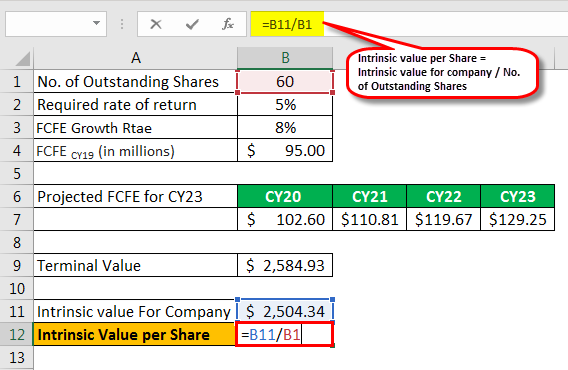

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Find The Intrinsic Value Of A Company S Stock In Excel Eps Multiplier Method Youtube

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

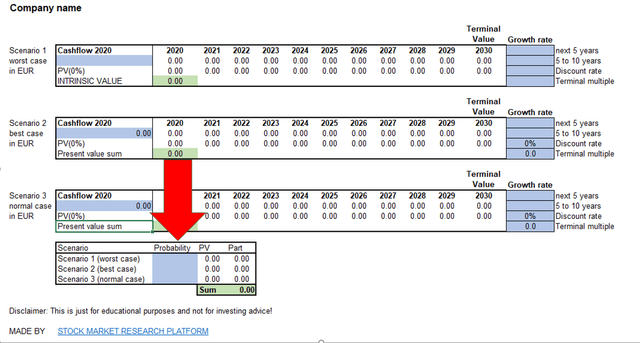

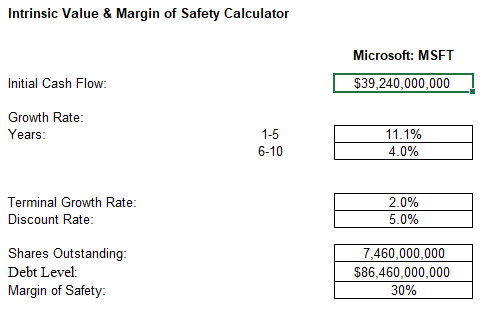

Intrinsic Value Calculator Excel Intrinsic Value Calculator Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

5 Steps To Calculate Intrinsic Value Youtube

How To Calculate The Intrinsic Value In Excel Like A Pro Beginners Getmoneyrich

How To Calculate The Intrinsic Value Of A Stock Excel Calculator

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template